Blockchain – an emerging opportunity for surveyors?

Every so often a revolutionary digital break-through emerges. The most recent being a technology allowing a decentralised, reliable and verifiable record of transactions, which is maintained across multiple computers using peer-to-peer networking and cryptography – blockchain.To get more news about blockchain field survey, you can visit wikifx.com official website.

Blockchain came to public prominence as the digital architecture underpinning Bitcoin and other cryptocurrencies that blossomed following the financial crash of 2008. It soon found potential applications in other fields, including a wide range of sectors in which RICS members and RICS-regulated firms operate.

But where will the technology add value? What are its limitations and risks? And how likely are today’s professional firms and other industry players to take advantage of the opportunity that blockchain represents?

This insight paper provides a balanced view of the outlook for blockchain, its application to the real estate, built and natural environment and construction industries, and what it could mean for RICS professionals and RICS-regulated firms looking to stay at the forefront of innovation.

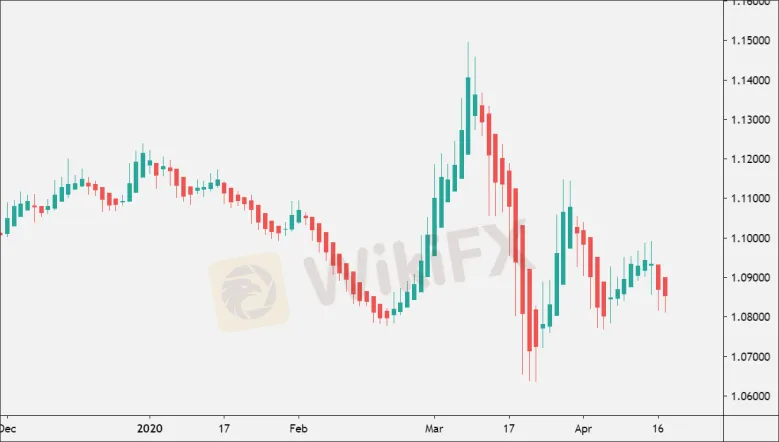

Speculation on the value of blockchain is rife, with Bitcoin—the first and most infamous application of blockchain—grabbing headlines for its rocketing price and volatility. That the focus of blockchain is wrapped up with Bitcoin is not surprising given that its market value surged from less than $20 billion to more than $200 billion over the course of 2017.1 Yet Bitcoin is only the first application of blockchain technology that has captured the attention of government and industry.

Blockchain was a priority topic at Davos; a World Economic Forum survey suggested that 10 percent of global GDP will be stored on blockchain by 2027.2 Multiple governments have published reports on the potential implications of blockchain, and the past two years alone have seen more than half a million new publications on and 3.7 million Google search results for blockchain.

Most tellingly, large investments in blockchain are being made. Venture-capital funding for blockchain start-ups consistently grew and were up to $1 billion in 2017.3 The blockchain-specific investment model of initial coin offerings (ICOs), the sale of cryptocurrency tokens in a new venture, has skyrocketed to $5 billion. Leading technology players are also heavily investing in blockchain: IBM has more than 1,000 staff and $200 million invested in the blockchain-powered Internet of Things (IoT).4

Despite the hype, blockchain is still an immature technology, with a market that is still nascent and a clear recipe for success that has not yet emerged. Unstructured experimentation of blockchain solutions without strategic evaluation of the value at stake or the feasibility of capturing it means that many companies will not see a return on their investments. With this in mind, how can companies determine if there is strategic value in blockchain that justifies major investments?

Our research seeks to answer this question by evaluating not only the strategic importance of blockchain to major industries but also who can capture what type of value through what type of approach. In-depth, industry-by-industry analysis combined with expert and company interviews revealed more than 90 discrete use cases of varying maturity for blockchain across major industries (see interactive).